FAACT-Pellens-Preis

On May 6, 2022, the FAACT Pellens Prize 2022 was awarded during the graduation ceremony of the Faculty of Economics at the Ruhr University Bochum. Through this prize, established by Prof. Dr. Bernhard Pellens by founding the Bernhard Pellens Foundation at the end of 2019, outstanding master theses and dissertations in the field of controlling, accounting, auditing, taxation or corporate finance are awarded, which are characterized by a high practical relevance in problem definition and result. The prize is open to students of the Ruhr-Universität Bochum and students of other universities if they were supervised by university professors who were academically trained at the Institute of Corporate Management.

The selection of the work to be awarded is made - on the suggestion of the Institute for Corporate Management (ifu) of the Ruhr University Bochum - by the board of the Alwin Reemtsma Foundation, which includes the Chancellor of the Ruhr University.

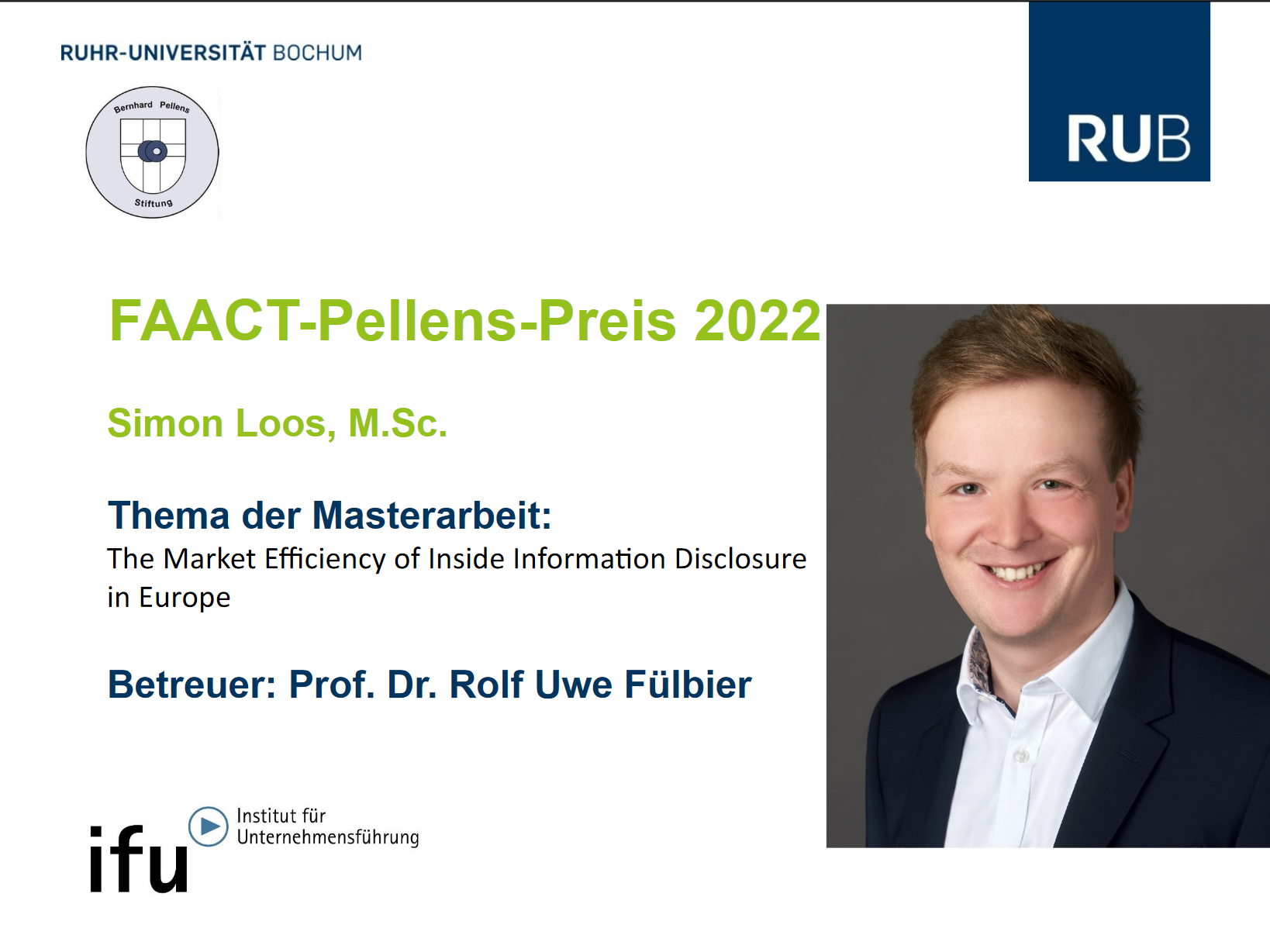

This year, the FAACT-Pellens Prize was awarded to Mr. Simon Loos for his outstanding master's thesis on "The Market Efficiency of Inside Information Disclosure in Europe", which received top marks and was supervised at the University of Bayreuth by Prof. Dr. Rolf-Uwe Fülbier, who was academically trained at the Faculty of Economics in Bochum. Prof. Dr. Devrimi Kaya, the executive director of ifu, could only award the prize on 6.5. 2022 in the absence of the laureate, as he was prevented by illness.

After completing his master's degree at the University of Bayreuth, Mr. Loos joined PwC in Düsseldorf as an Associate in Assurance Industrial Services in the fall of 2021.

The Market Efficiency of Inside Information Disclosure in Europe

In 2014, the European Union issued the Market Abuse Regulation (MMVO) with the aim of creating a uniform and stronger legal framework in all EU member states that improves market efficiency and combats market abuse. One instrument of this regulation is the publication of insider information (Article 17 MMVO), which, among other things, obliges capital market-oriented companies to publicly disclose insider information that directly affects them as soon as possible. Insider information is information which is not publicly known and which, if made public, would be likely to have a significant effect on the share price of the company (e.g., a profit warning, an insolvency filing, capital measures, or announcements/adjustments of dividends). The immediate publication of this information is intended to ensure that all market participants have access to the same information at the same time and to prevent insider trading.

Mr. Loos is conducting an event study in his final thesis that examines the effects of the publication of insider information on the German capital market. The data basis for his study is all insider information published by all companies listed on the Regulated Market of the Frankfurt Stock Exchange between 2012 and 2020 and stored in the archive of the Deutsche Gesellschaft für Ad-hoc-Publizität. Compared to previous studies, Mr. Loos' analysis provides current insights into the general market effect of the instrument across the Regulated Market, including first-time insights into the effect in the General Standard market segment, and its potential to improve market efficiency. The results of his event study show that market reactions to the publication of inside information vary across indices, market segments, publication times, and keywords in the subject of the publication. The analysis of market efficiency shows that only for companies of well-known German stock indices (i.e., DAX, MDAX, SDAX, and TecDax) does the German capital market fully price the published inside information into the market price on the day of publication. In summary, Mr. Loos' study shows that the instrument of publishing insider information improves market efficiency and that the German capital market partially prices in new information efficiently.